We are real estate specialists with an in-depth expertise in rental housing and services for retirees and active seniors.

Statistique

Objectives

2022

.

More than

400 M $

in managed assets

More than

3100

housing units

Strategy

Our investments are the result of a rigourous analysis of the market and demographics, and represent an opportunity for investors seeking stable income and the creation of long-term value.

Our initiatives are located in urban and peri-urban territories in the province of Quebec; areas which have a high concentration of our target clientele.

Our goals are the creation of long-term value and a distinctive contribution to the community. The management of environmental, social and governance (ESG) factors is aligned with our philosophy and contributes to the achievement of our objectives.

Our approach is based on the vertical integration of our activities, in order to benefit from the expertise of the members of our organization at each stage of our development.

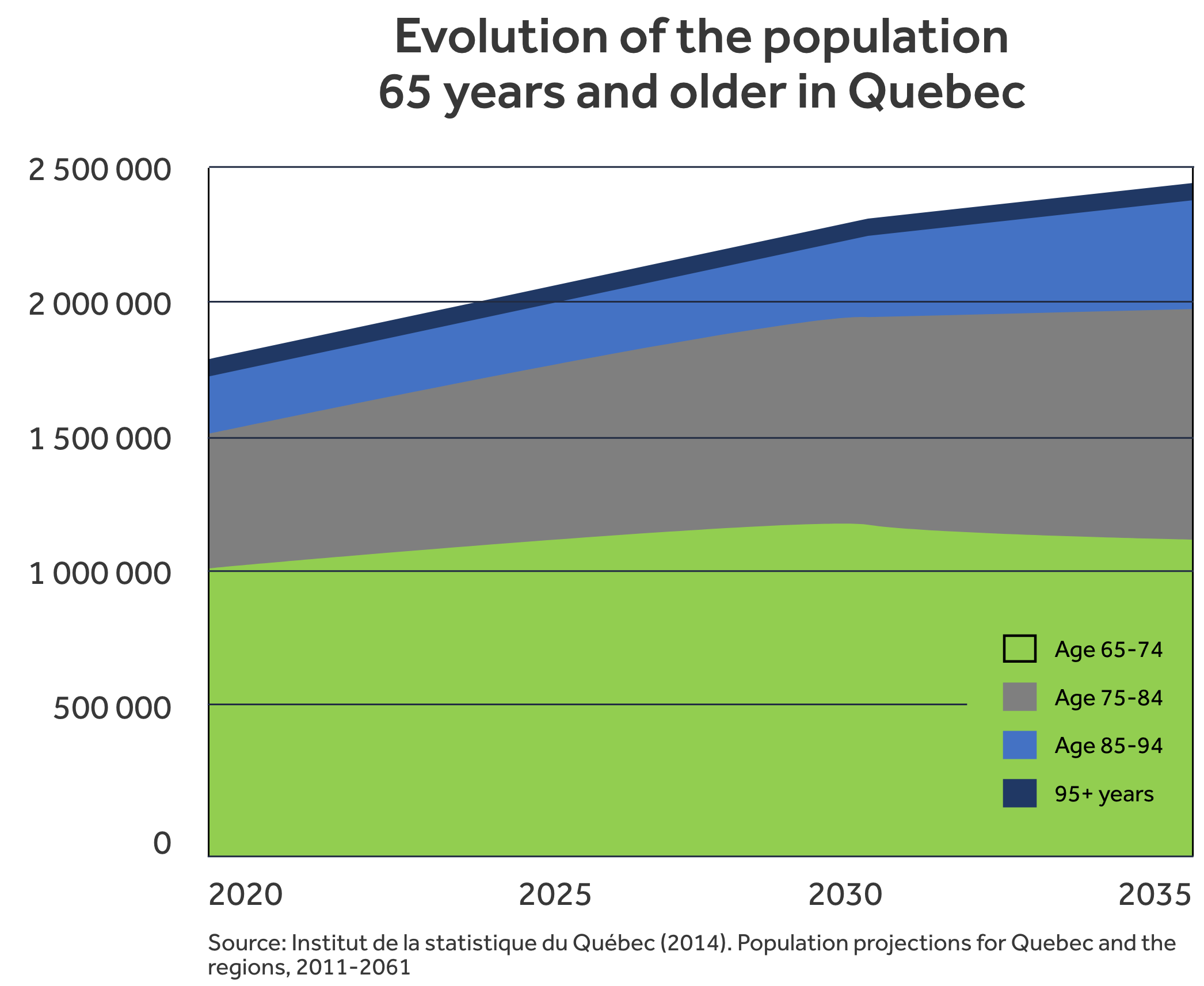

In the next 15 years, the population aged 65 and over will increase by 45%, rising from 1.7 M to 2.5 M. This increase is mainly due to the population aged 75 and over, which will increase from 750,000 to 1,500 000 people; an increase of 100%.

In Quebec, more than 17% of people aged 75 to 85 live in retirement homes (all types of residences combined). This proportion drops to 34% for seniors aged 85 and over.

Seniors today are living longer, but most importantly, they are healthier, better educated, wealthier and more active than their predecessors. This paradigm shift has a direct impact on the product and services expected by this evolving clientele.

We want to develop and consolidate the private retirement home market and develop apartments for young active retirees in urban and peri-urban areas of the province of Quebec.

In these targeted areas, the density of the population aged 65 and over allows us to develop products and a range of services adapted to this clientele.

Guided by the nature of our operations, infrastructure and clientele, our management objectives are to generate stable income, long-term value and a distinctive contribution to the community.

Since its creation in 2019, Fonds immobilier Champlain RPA has implemented strategic initiatives to ensure development with a solid and sustainable basis. Respect for environmental, social and governance (ESG) factors is embedded in our management philosophy and contributes to the achievement of our objectives.

We have embarked on this path because sustainability is at the heart of our approach.

![]()

Respect de l’environnement

- Environment

- Environmental policies

- Energy efficiency

- Climate change

![]()

Social

- Human rights

- Labour standards

- Health and safety

- Employee development

![]()

Gouvernance

- Ethical standards

- Diversity

- Commitment of all parties

- Performance

We have an integrated approach allowing us to take advantage of the knowledge of each specialty in order to develop the most suitable projects. Our growth is achieved by building new private senior residences and apartment buildings catering to active seniors and, when the opportunity arises, acquiring existing companies that reflect our values.

In this way, we have brought together experts who have carried out major real estate projects in multiple sectors such as private senior residences, high-density residential complexes, major shopping centres, as well as innovative development projects; experts such as:

- Specialists in negotiation and land acquisition to identify opportunities and investment levers.

- Construction professionals with a knowledge that is both sharp, extensive and specific to the field of retirement homes.

- Construction professionals with a knowledge that is both sharp, extensive and specific to the field of retirement homes.

Our performance objectives are commensurate with the growth potential of this market, our financial resources and the expertise of our team.

- Alain Filion, President and CEO

Team

Charles Trudel

President and Chief Executive Officer and Chief Financial Officer.

A real estate professional for over 10 years, Charles Trudel is a Chartered Professional Accountant with over 24 years’ experience in financial management and corporate finance. He worked in financial management for a number of companies in various industries before joining BMO over 14 years ago. His diversified experience has enabled him to hold several positions within BMO in commercial and corporate financing and management. Among other things, he successfully headed up BMO’s Real Estate Financing group for Quebec, where he quickly established a solid reputation in the industry for his financing packages and the scale of the projects in which he participated.

Over the past 10 years, he has been involved in the realization of several major projects in Quebec and Canada.

Today, he heads the Champlain Real Estate Fund team, where he applies his experience and expertise to help the Fund’s partners maximize value.

Portfolio

Longueuil

Longueuil - 2022

This innovative “Fitwel” certified project will offer a 65+ component in both a rental version as well as a private retirement home option with adapted services for a demanding clientele looking for a stimulating living environment. Built by a renowned Quebec architecture firm, this carbon-neutral establishment will transform the perceptions of private senior residences, through both exquisite design and environmental symbiosis. Featuring abundant windows as well as indoor and outdoor common areas promoting a rich social life, this project is strategically located to facilitate the movement of our tenants while offering them a range of neighbouring businesses.

Résidence Le Jules-Verne

L’Ancienne-Lorette - 2017

Located in Québec City, in the Ancienne-Lorette neighbourhood, this large-scale complex has more than 500 units of different types, with activity areas, gardens, technology initiation centre, virtual games, swimming pool, café-bistro, and an interior hall accessing shops and local services.

Like its visionaries, who embody pride, understanding and respect, the Jules-Verne residence is a place where these values are omnipresent and are also reflected in the highly qualified staff and residents.

Château Bellevue Saint-Nicolas II

Lévis - 2022

Located in a popular area of Lévis’ Saint-Nicolas neighbourhood, the Château Bellevue Saint-Nicolas is built on 14 floors and has 321 units, including 33 care units. This residence offers you splendid modern facilities, such as indoor and outdoor common areas that are refined and provide a wonderful variety for extended and ultimate pleasure. Among others, you’ll find: a bowling alley, cinema, indoor and outdoor petanque, a billiards room, swimming pool, hair salon, and much more!

What’s more, from the 4th floor, residents enjoy an unobstructed view of the Saint Lawrence River and Québec City.

Château Bellevue Shawinigan

Shawinigan - 2019

Located in downtown Shawinigan, this 10-storey building has 317 units, 32 of which are dedicated as care units. Among the amenities available: a cinema, a meditation space, a carpentry and storage room, relaxation room, bistro, gymnasium with swimming pool and spa, a library, bowling alley, convenience store, pharmacy, and hairdresser. The dining room and the main activity room are located on the 9th floor offering a splendid view of Shawinigan and the Saint-Maurice River.

Château Bellevue Val-Bélair

Québec

Located in Québec, in a booming area near a magnificent bike path, the residence is surrounded by a diversified commercial offer. The 10-storey building includes 293 units, 24 of which are dedicated to care units. Amenities include: a space for contemplation, a woodworking shop, cinema, pharmacy, billiard room, swimming pool and spa, gymnasium, conference room, relaxation room, and craft room. Each floor has its own common lounge. The dining room and the main activity room on the 10th floor offer a view of Val-Belair.

Château Bellevue - Saint-Nicolas

Lévis - 2014

Located on Route des Rivières, a commercial and residential artery, the residence benefits from several local shops, a cinema and some restaurants. The 11-storey building includes 254 units, 12 of which are dedicated to care units. Among the services, there’s a convenience store, hair salon, exercise room, cinema, a space for meditation, community room, as well as a craft and carpentry workshop. Residents enjoy an unobstructed view of the river and Québec City from the 4th floor.

Résidence Ste-Anne - Rawdon

Rawdon

Located near the main artery of Rawdon, Résidence Ste-Anne is surrounded by both the municipality’s commercial and residential areas. The 4-storey building of 4 includes 164 units. Amenities include a space for contemplation, an infirmary, three common rooms, exercise room, hair salon, and cinema. Most common spaces are located on the ground floor.

Résidence Bromont

Bromont

Located in the area known as Golf Club du Vieux Village, Résidence Bromont

Is a pillar in the quiet and quaint countryside, made up mainly of single-family homes. Résidence Bromont is bordered by a golf course. The building is located within walking distance of Shefford Street, the main street with all city services. The 4-storey building

includes 84 units. Among the amenities: an infirmary, two lounges (one of which has a lovely fireplace), community rooms, bistro, conference room, training room, billiard room, and a hair salon. Most common areas are located on the ground floor.

Résidence du Saint-Rosaire

Mont-Jolie

The Residence du Saint-Rosaire is located in Mont-Jolie’s historic city centre. This 4- storey building includes 92 units. Common areas include lounges, dining room, spaces for contemplation, art studio, hairdresser, cinema, billiards room, and a doctor’s office. Most common areas are located on the ground floor.